Liquidity Provision on DeFiEdge

If you think of providing liquidity to any protocol, you would see what are its pools, volume, TVL and other important parameters.

Currently, one protocol that has the most volume and above mentioned parameters is Uniswap.

Uniswap is the most popular decentralised crypto exchange, even without any liquidity mining /or farming rewards for investors. But most importantly, what a liquidity provider looks for is ease of providing liquidity. Uniswap V3 has become capital efficient but at the cost of easy LPing. Uniswap has introduced concentrated liquidity that lets users add liquidity to a specific range. This makes it capital efficient as liquidity is just lying idle in a full range and fees are only allocated to those liquidity providers who have chosen a correct range. Narrower the range, more the fees earned.

But If prices go out of range, not only do liquidity providers stop earning fees but their assets are concentrated to the lesser valuable asset. So if a user has liquidity in the USDC/WETH pool and chooses the range 2900-3200, this user will earn fees only until the price of WETH token is between 2900 and 3200.

WHAT IF IT GOES ONE OR THE WAY?

If the user has added $1000 to the pool and price goes below 2900, liquidity is concentrated to WETH and gets WETH worth $1000 and if it goes above 3200, it is concentrated to USDC and gets USDC worth $1000.

|

|---|

This makes liquidity providers check graphs and positions every time.

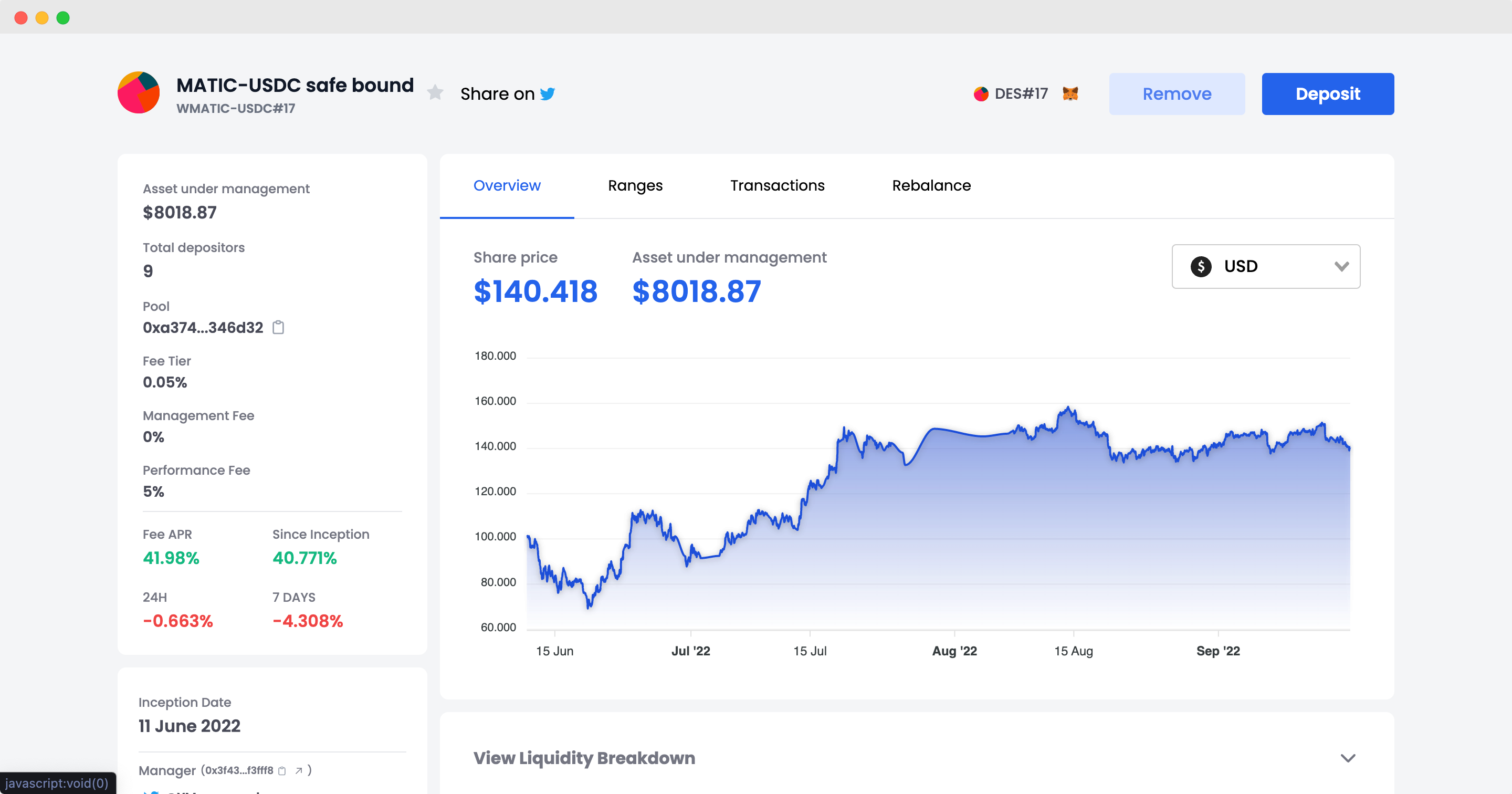

DefiEdge lets liquidity providers invest in various strategies, these strategies are made and managed by experienced strategy managers.

Liquidity providers can easily add single or dual assets to strategies.

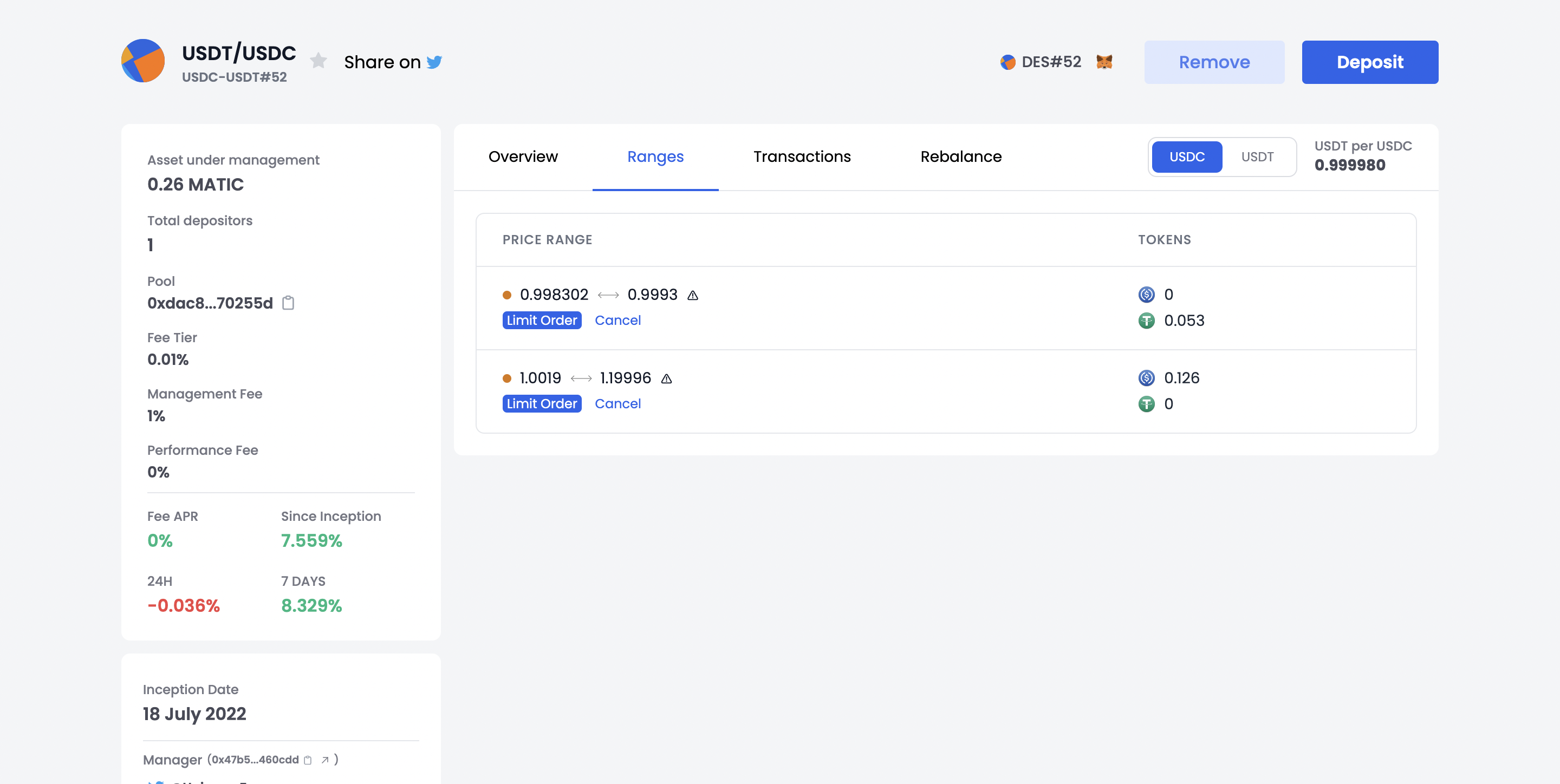

DefiEdge lets strategy manager create 20+ positions and also place Limit Order, these features help strategy managers maximise profits and this results in high APY

|

|---|

As a liquidity provider if you provide liquidity on Uniswap V3 directly, you can create one position and if that position goes out of range, the position needs to be rebalanced and this requires the liquidity provider to swap required assets/tokens, calculate range, and pay gas fees. This requires time and constant checking, to ease this process liquidity provider can just invest in any strategy by any strategy managers and strategy manager takes care of rebalancing and most importantly strategy manager pays gas fees also.

Ready to invest?, Check out how to deposit into your favourite strategy today.

Advantages Of Providing Liquidity on a Managed Strategy

Strategy managers look for a protocol that has all features to ease the process of creating a strategy. Strategy managers require liquidity providers that are able to easily invest in strategies. They also need a platform that lets them use a DEX like Uniswap to its full potential. A quick and fast, easy to use platform. DefiEdge is an asset management protocol built on Uniswap v3. Strategy managers can choose a Uni v3 pool, their suitable fee tier and create a strategy in just five simple steps. Guide to creating a strategy can be found here. DefiEdge is a one stop destination for creating a position on Uni v3. Strategy managers can easily create 20+ positions on uni v3.

|

|---|

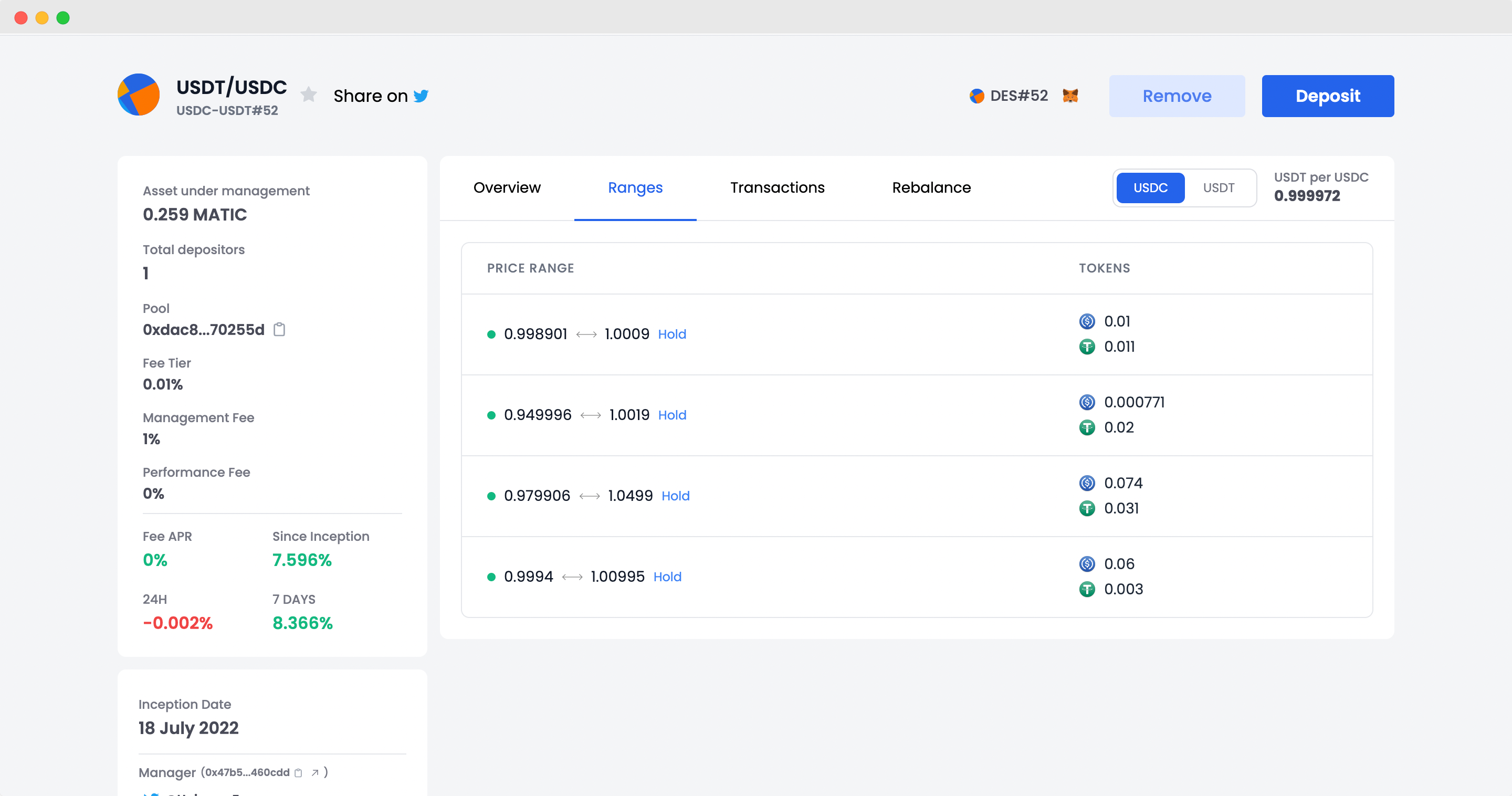

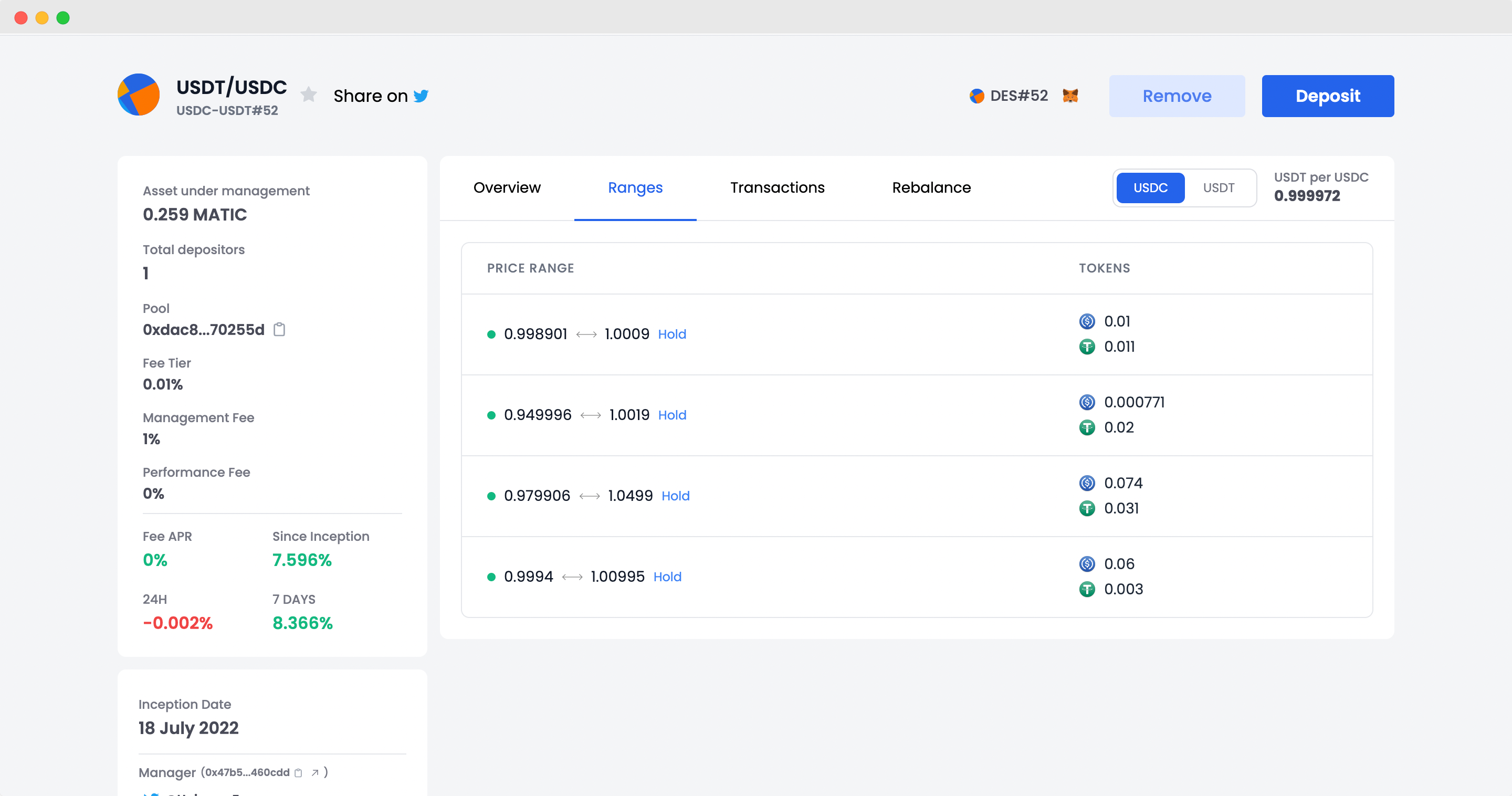

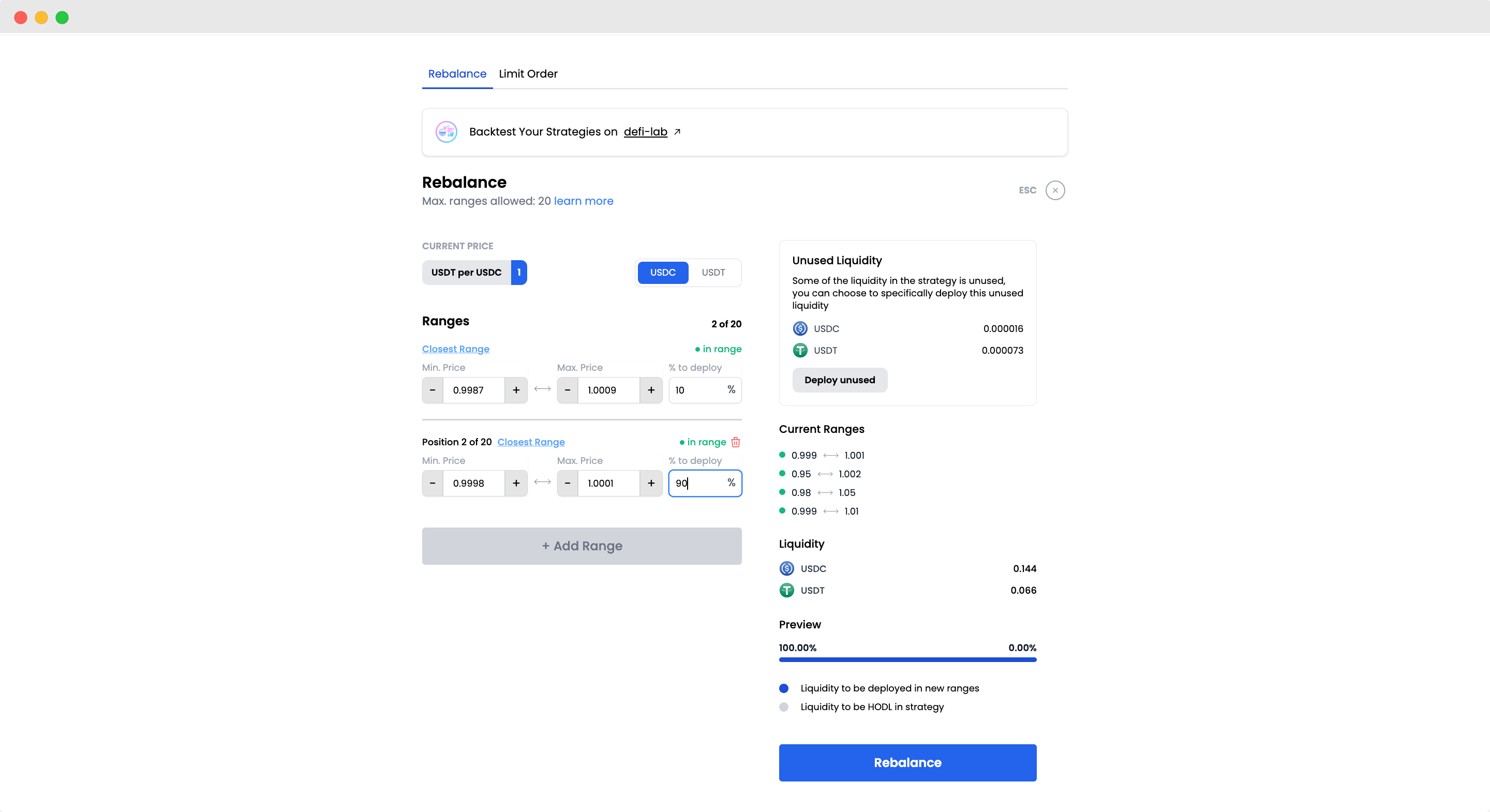

They can rebalance in one-click. What they need to do is enter the ranges, percentage of liquidity to deploy and swap.

|

|---|

All calculations regarding swap are done in one-click. Partnership with 1inch helps in getting the best swap rates.

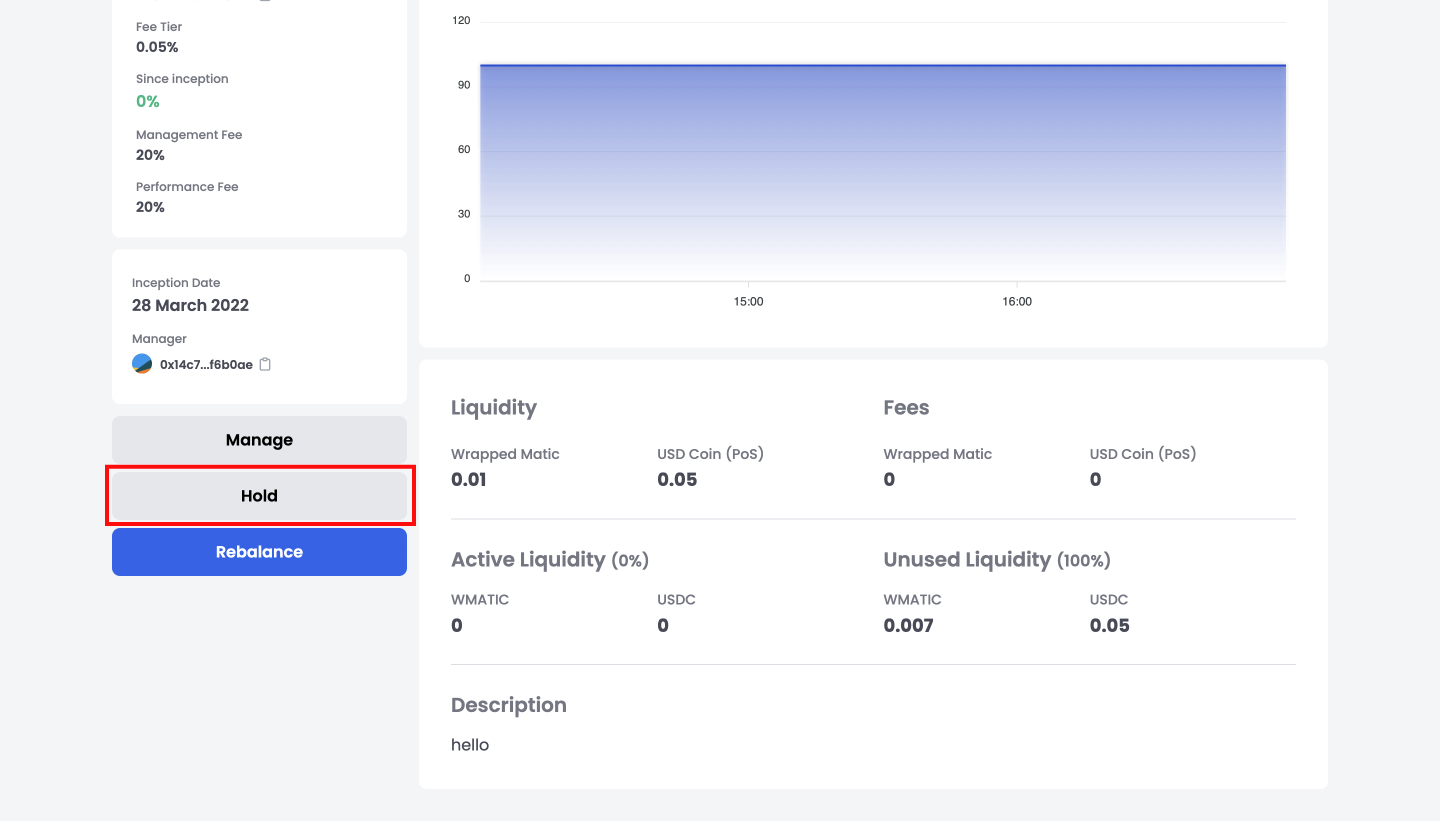

Think that the market is bearish, and strategy will perform better if funds are just on HOLD?

|

|---|

- Easily hold complete funds of the strategy or of a specific range. Simply adds funds to unused liquidity.

Use Uni V3 concentrated liquidity feature to its limits by using limit orders. Just create a range and set a limit order for that range.

|

|---|

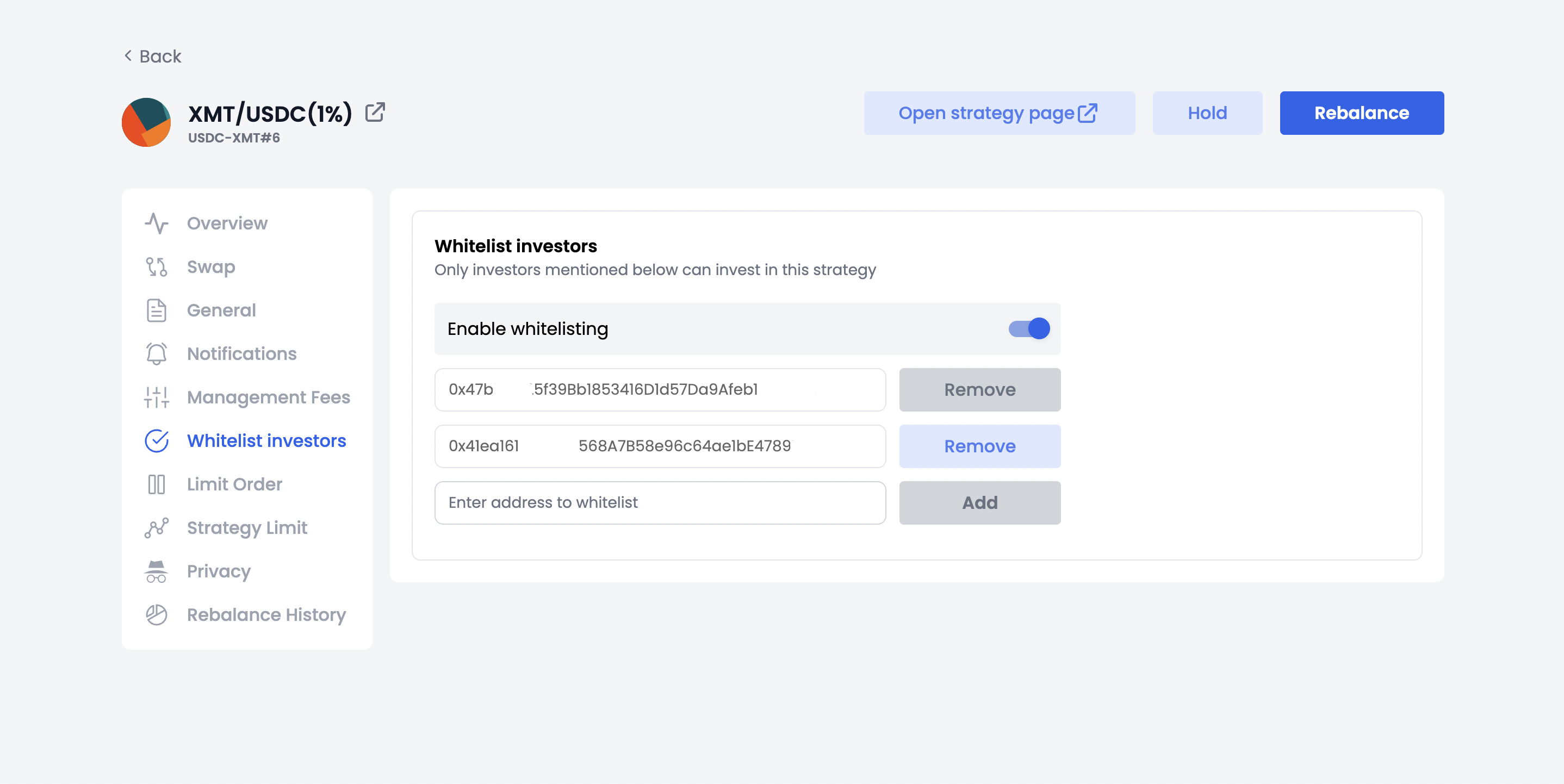

- Among other features/things strategy managers can also add specific wallet addresses that can invest in their strategy.

|

|---|

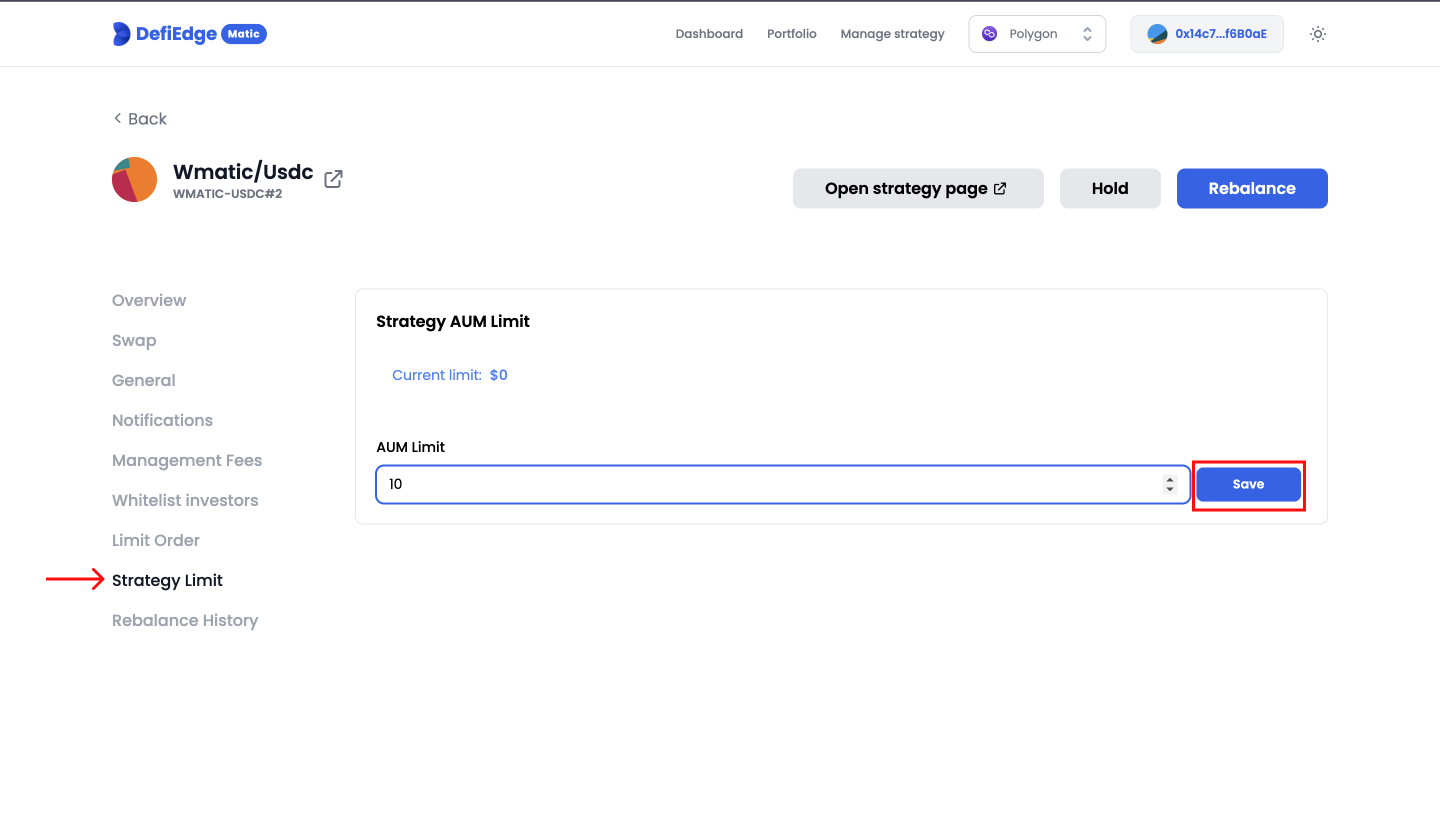

- Set an asset under management limits.

|

|---|

- Create private or public strategies.

|

|---|

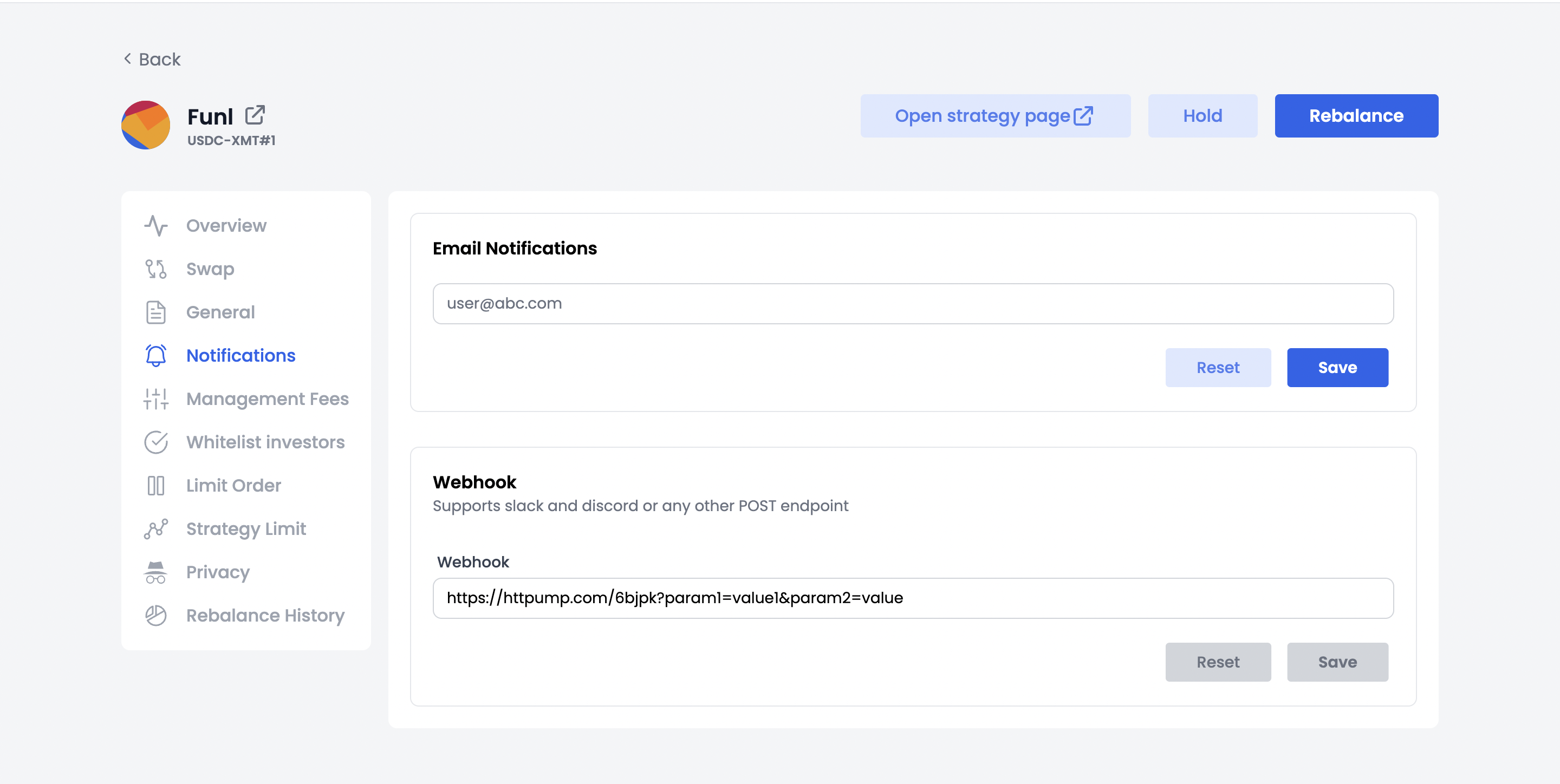

- Also enable notifications that notifies strategy managers everytime their strategy goes out of range.

|

|---|

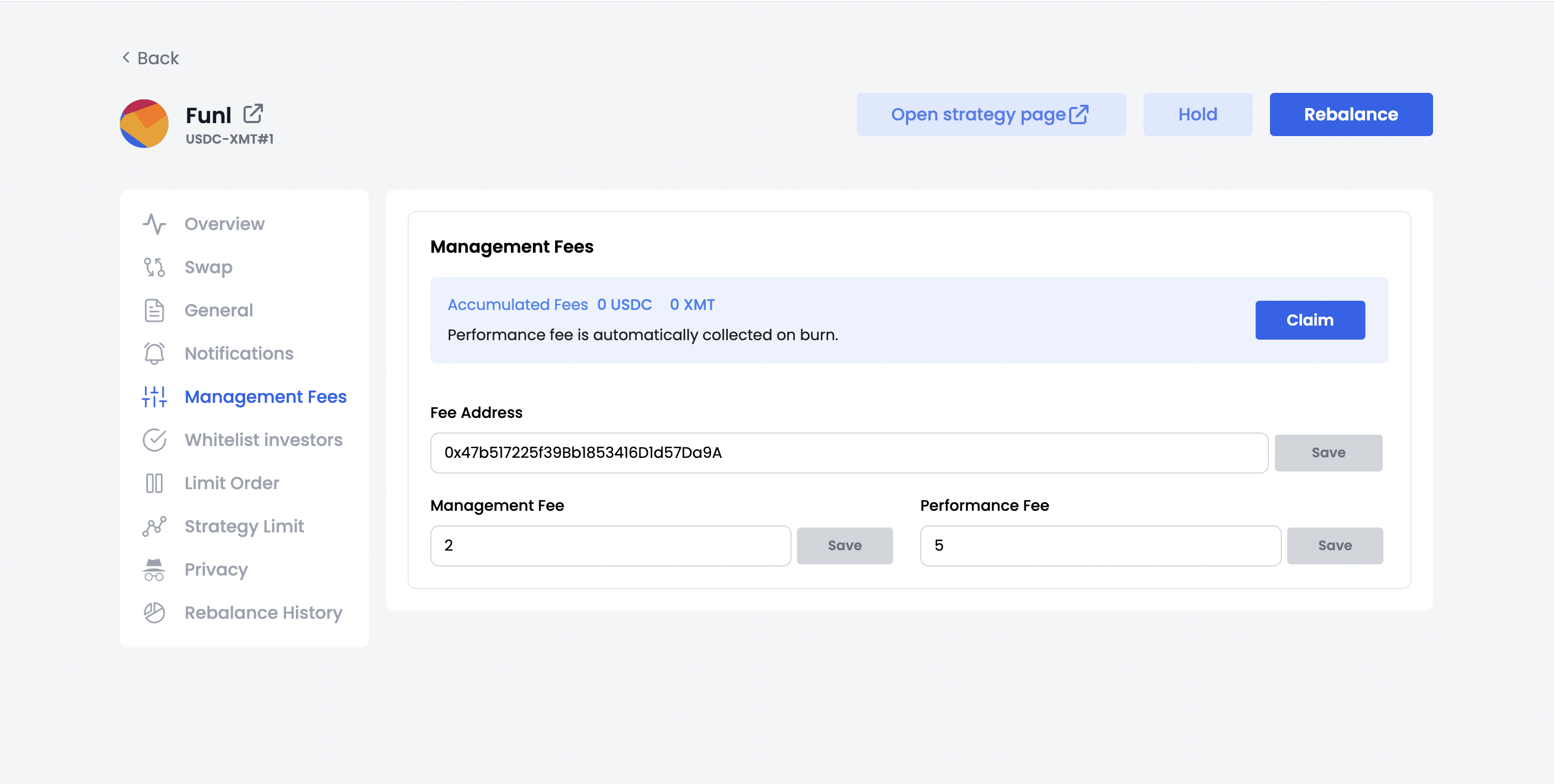

- Set management and performance fees as per their requirement.

|

|---|

EXCITED !!!

In case you want to create your own strategy. We have made a step-by-step tutorial for you here